Life Insurance is in place for the educated, successful, rich and wealthy. 90% of all policy owners would fall under these categories. This is a quick guide to share with you the benefits of cash value life insurance. This the information that even 90% of current Life Insurance Policy Owners do NOT know...

1. Cash Value grows tax deferred.

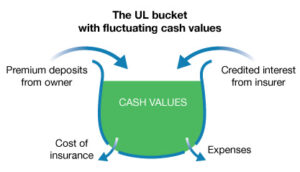

a. Cash Value will not be taxable while it remains in the life insurance policy. (ATTENTION! This is the whole point of this website) As a policyholder pays their premiums for permanent life insurance, you can set it up to grow additional cash value via dividends, credited interest, & additional cash investments.

2. Using Loan options similar to a 401(k); Cash Value can be accessed Income Tax-Free.

3. You will be able to take the minimums or set your term and interest rate.

4. When you repay your loan. You pay yourself(retirement funds) back plus interest not a bank. Gain Creditor Protections.

5. Tax-advantaged lifetime benefits with death benefits that can also grow.

6. Can Provide supplemental retirement income.

7. Can be used to pay for college, then you can pay it back and used it again to put a down payment on a new home.

8. Can be used to buy a car

9. Often used as a general savings vehicle that may be accessed income Tax Free,

and Penalty Tax-Free, regardless of the policyholder’s age or use of the funds,

provided the policy is not a modified endowment contract (MEC).

10. No Market Risk and Guaranteed rates associated. (ATTENTION! There is business risk!)

11. As a policyholder you will receive a Guaranteed Cash Value Interest Rate of 4%

and a Dividend based on the Insurance company’s surplus.

12. Historical returns with the larger Mutual companies range between 5 – 7%

(Contact us for examples)

14. If a Beneficiary is a family member a dependent, your cash value may be

protected from creditors.

15 Become your own Bank with Life Insurance's Borrowing Advantages:

a. Policy loans may be taken from a Life Insurance Policy’s Cash Value.

b. Policy Loans are not required to be paid back. Terms are set by the policy

owner

c. If One takes a Policy Loans and repays over any period of time, the cash value

balance will be restored to what it would have been if a loan was never taken.

i. The Insurance company will continue to credit Dividends to your policy

cash value and money outstanding in the form of a loan.

ii. This is done by holding a portion of your death benefit as collateral.